To explore pre-pack trends, I reviewed 120 SIP16 statements issued over the last 3 years. Coupled with the Insolvency Service’s intriguing revised guidance on the phoenix rules and their summer report, I’ve been wondering how far we have come in 3 years and what else needs to change.

In this blog, I explore:

- What is the Government’s timetable for changing pre-packs?

- How many pre-pack purchasers themselves go out of business? And how many of these were connected purchasers?

- Does the survival of pre-pack purchasers indicate that the Pool is working?

- What is the trend in using the Pool?

- Why do more connected Newcos fail?

- Are there many serial pre-packers? Do they use the same IPs?

- What effect will the new anti-phoenix provisions have?

- What is going on with the Insolvency Service’s revisions of their S216/17 guidance?

- Will HMRC’s move to preferential creditor change things?

- How should pre-pack regulation change?

Has the heat on pre-packs cooled off?

A significant item on the Insolvency Service’s to-do list for the past few years has been the “pre-pack review”. The Service’s 2017 Regulatory Report (published in May 2018) referred to the Government’s “review to evaluate the impact of the voluntary measures in order to inform any future decisions on whether legislative measures are required to regulate connected party sales in administration” and the anticipation back then was that the review would be completed by the autumn of 2018.

The Service’s 2018 Regulatory Report (published in May 2019) stated that the Service “have carried out” the review and “the Government hopes to be able to publish the findings and outcome from the review shortly”.

Of course, the Government’s more pressing pre-occupations inevitably have delayed this publication. Also, since May 2019, the IS/RPB focus seems to have been squarely on the regulation of Volume IVA Providers. Perhaps there has been little to say on pre-packs because the Service has been waiting for its review to reach the top of the Secretary of State’s pile, but that document is a year older now. I wonder if its findings and outcome are quite so relevant.

The sunset clause is setting

Hanging over this topic, of course, is Section 129 of the Small Business, Enterprise and Employment Act 2015, which allows the Government to make regulations prohibiting or imposing conditions on Administration sales of property to connected parties – pre-packs or otherwise.

This power will end on 26 May 2020.

There is no time left to consult on draft legislation. The review was carried out behind closed doors and remains under wraps. Presumably, the profession will have no opportunity, publicly, to engage in the proposals.

Have we seen any hints about what we are likely to see? I suspect the RPBs have been involved in the Service’s review, so I was intrigued to read the IPA’s Oct-19 response to the Service’s call for evidence on regulation slip in: “the IPA supports the consideration of changes to the pre-pack pool to better scrutinise connected party sales”. As we all feared, the focus still appears to be on the Pool.

In its May-18 submission to the Service’s pre-pack review, R3 emphasised the value of looking wider: “The Government should support and help develop the reforms made in 2015 and should look at the impact of the reforms as a whole, not just the Pre-pack Pool.” Hear, hear.

Presumably, the Government’s review will consider the question: are pre-packs any different now than they were before the November 2015 changes?

What makes a pre-pack bad?

The answer to this question very much depends on who you ask. I think that IPs in general will say that a bad pre-pack is one that does not maximise the realisation of the company’s property. I think that the world before the Teresa Graham report would have said that a bad pre-pack was one that did not instill confidence that the company and the IPs were acting in creditors’ best interests. That’s what the revised SIP16 and the Pool were intended to fix by providing more information on the pre-pack strategy in the SIP16 Statement and by the Pool providing an independent opinion on whether there are “reasonable grounds” for the proposed deal. One of my frustrations with the Pool is that they have never explained how they measure such reasonableness. How do they decide what is bad?

In my review of 120 SIP16 Statements, I came across one brave IP who, despite the prospective purchaser receiving a negative opinion from the Pool member, decided to do the deal anyway. In his Administration Proposals, he had added a one-page summary, over and above the standard SIP16 disclosure, of why he had decided to complete the sale. It made perfect sense to me and went to the core of the Administrator’s role: to achieve an Administration objective, which generally involves returning as much value as possible to creditors. The Administrator also had explained why he believed the submission to the Pool was materially flawed.

What about the survival of Newco?

One of the accusations levelled against pre-packs is that they simply give new life to a business that ought to be terminated. The more sceptical suspect that some directors hatch plans to phoenix by pre-pack and what is to stop them doing it all over again?

Therefore, I decided to test the survival of Newco: how many companies that purchased a business by a pre-pack later terminated?

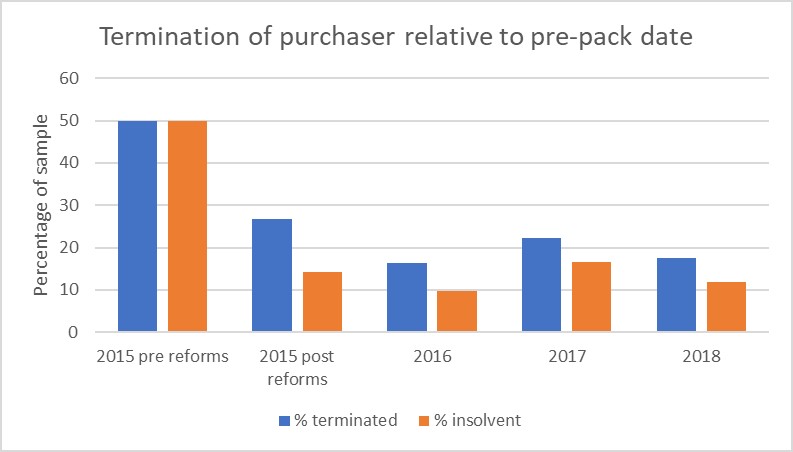

* Sample size: 120 cases with no repeat of Administrator firm in any one period. “Terminated” includes dissolutions and MVLs.

Now I know that, of course, the more recently the pre-pack occurred, the more likely Newco will still be alive. But I still find this graph striking: my 2015 pre reforms group dated from June to October 2015, so how is it that their outcomes are so different from Nov/Dec 2015 cases? This suggests to me that the measures introduced in November 2015, including the new SIP16, significantly changed the face of pre-packs.

Doesn’t this show that the Pre-Pack Pool is working?

No! Only 6 cases in my sample involved the Pool. It’s true that all those Newcos are still live companies, but setting those aside, the graph is still the same shape: the change in the survival rate of Newco from before the 2015 reforms cannot be attributed wholly (or even largely) to the Pool.

The Pre-Pack Pool’s 2018 report described its aim as “to provide assurance for creditors that independent experts have reviewed a proposed connected party pre-pack transaction before it is completed”, but it then acknowledged that “for this independent scrutiny to be seen to be effective, reference to the pre-pack pool needs to be seen as an essential part of the pre-pack administration process by both creditors and prospective applicants”. So… at the moment, there is general apathy towards the Pool – from creditors and applicants – so it cannot do its job of providing assurance that someone other than the IP has considered the proposed sale..? But perhaps the general apathy towards the Pool is because creditors and applicants do not see a need for the Pool opinion. Perhaps they do not require the Pool’s opinion, not least I think because it is not at all clear what the Pool is measuring.

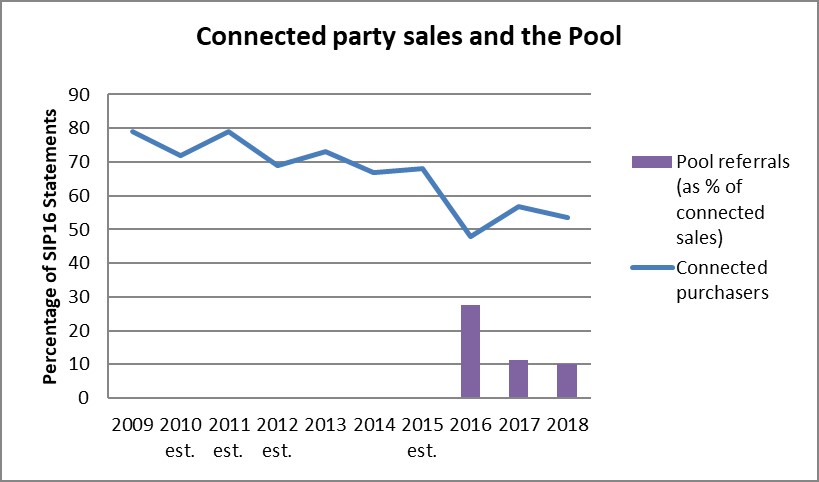

How many pre-packs has the Pre-Pack Pool reviewed?

Use of the Pool continues to fall. The Pool’s 2018 report stated that, in 2018, there were 24 referrals to the Pool. This is more referrals than in 2017, when there were 23 referrals, but as a percentage of the total number of connected party sales, 2018’s referrals were down on 2017.

With such a tiny referral rate, I do not think that the Pool can take any creditor for any material changes in pre-pack practices.

Would it help if the Pool were made compulsory for all connected party pre-packs?

Help how? What is the ill that the Pool is trying to remedy? Is it still the case that there is a general lack of confidence? If there is a general distaste for connected pre-packs, does this not simply stem from the general perception that it cannot be right for a director to fold Oldco, buy the business and assets, and then trade on with Newco? I cannot see that increasing the frequency of the Pool’s opinion will counteract this perception.

I would be very interested to read how the Government’s review explains what is currently wrong with pre-packs. I think that many in the profession think that, if the Government simply wants to “do something”, then making the Pool compulsory is the least damaging answer and far preferable than restricting Administrators’ powers to complete pre-packs. That’s as may be, but I cannot see that expanding the Pool’s scope would achieve anything other than adding to the costs of the process.

Are connected party Newcos any more likely to fail?

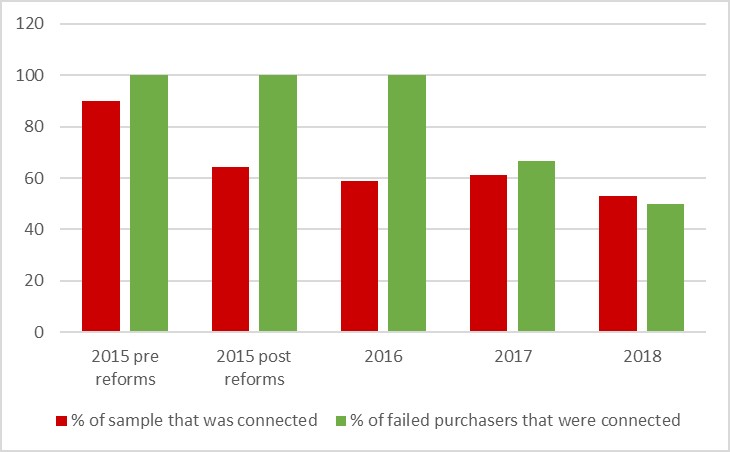

This graph looks at how many of the failed Newcos had been connected to Oldco, compared to how many of the sample as a whole had been connected:

* Failures exclude terminations by MVL or dissolution

This graph does indicate that, with the exception of 2018 pre-packs, there has been a greater percentage of connected party Newco failures than there should have been if they were evenly spread across the whole population of Newcos… in my small sample, at least. That’s not such good news for anyone hoping to avoid regulation.

My personal view is that this demonstrates how some directors of failing businesses struggle to face realities: they cannot come to terms with the thought of walking away from the business. Of course, it is especially difficult for those who have tied up their personal assets in the fate of the business. I wonder if connected potential purchasers need to be better advised on the challenges facing them, how Newco risks repeating Oldco’s mistakes and may even face new challenges in retaining disillusioned customers and suppliers. The problem is that the potential Administrator is not in a position to give that advice, given the conflict of interests. So does this mean that no one helps these directors face realities?

What about serial pre-packers?

Of course, there could be another reason for connected Newco failures: are some directors abusing pre-packs to dump debts and start again? If this is the case, then wouldn’t we see serial pre-packers: if a director gets away with it once, then wouldn’t they be sorely tempted to do it again a few years down the line?

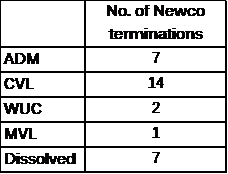

Firstly, here is a breakdown of the terminations in my sample:

So yes, I accept that seven Newco ADMs is a very small sample, but this in itself suggests that serial pre-packing is not widespread. Arguably, though, even this small number is too many.

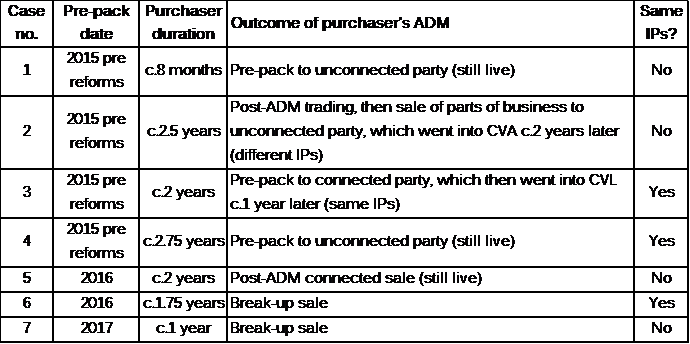

Here is a summary of the fates of the purchasers who themselves went into Administration:

It is interesting that two of the businesses were sold to connected parties for a second time. It is alarming to see that one of those Newco-v2s went into CVL c.1 year after the second pre-pack sale. It will be interesting to see how the other second connected purchaser fares with a bit more time.

The breaking point seems to be generally around the 2-year mark. If this is the case, then it is encouraging to see that only one 2017 case and no 2018 cases failed. Contrasting this with the four 2015 pre reform pre-pack purchasers that failed, doesn’t this again suggest that something happened with pre-pack practices after the 2015 reforms? The purchasers after the 2015 reforms seem more robust than those before. Also, my pre-2015 reforms cases only number 17% of the total, so it is even more disproportionate that so many purchaser failures appear in this group.

… and again, I cannot see that the Pool can take credit for this. Did something else happen to refine the pre-pack process?

Should IPs be handling serial pre-packs?

It is alarming to see that, in one of the cases (Case 3), the same IPs then carried out the CVL of the second connected Newco. I cannot tell you what happened to the assets of the Newco-v2 in this case, because the liquidators have not yet filed a progress report (despite the fact that the anniversary was in September!). Even if the IPs felt that they were not conflicted from the appointment, surely there would be a significant perceived conflict, wouldn’t there?

Will the new anti-phoenix provisions change things?

In essence, the Finance Bill 2019-2020 provides that, where a director has been involved in at least two insolvent companies in a 5-year period and the same director is involved in a further Newco, HMRC can make that director joint and severally liable for the past tax liabilities of all those companies (https://www.gov.uk/government/publications/tax-abuse-using-company-insolvencies).

On the face of it, Cases 3 and 5 above might have fallen foul of these provisions (subject to the finer detail of the criteria) had they been in force at the time. Of course, it is possible that other cases in my sample had been bought out of a pre-pack prior to 2015, so perhaps it would have affected more. I also haven’t analysed the 14 CVLs, which may include some other cases where directors have sought to stay in the same business.

Although the provisions will only capture tax liabilities arising after the legislation comes into force, I think the new Finance Bill 2019-2020 has great potential to discourage serial pre-packers and thus I think it could do more to improve creditors’ confidence in pre-packs than the Pool.

I also think that the Insolvency Service’s new approach to R22.4 may impact on connected party pre-packs.

What have the current phoenix provisions got to do with pre-packs?

Over the past year, the Insolvency Service have been tweaking their “Re-use of company names” guidance.

In March 2019, Dear IP 87 tweaked the guidance to make clear that, although R22.4(3) provides a 28-day timescale for issuing the notice to creditors/Gazette, it must nevertheless be given and published before the director begins acting in relation to a successor business. Then, in November 2019, their online guidance expressed the opinion that directors “cannot give notice under this rule if the company is not already in liquidation, administration, administrative receivership or in a CVA”.

So how can a R22.4 notice be given in a pre-pack?

If the sale is completed on the day that the Administration begins, it seems to me that it will be impossible for anyone to comply with R22.4 unless the purchaser decides to close its doors for a couple of days to allow time for the notices to be “given and published”.

But the phoenix provisions only apply to liquidations, not Administrations, don’t they?

True, a director can only fall foul of the phoenix provisions if Oldco goes into liquidation. Of course, some Administrations do exit into liquidation. Assuming that moves to CVL occur c.1 year after the Administration begins, the stats for the year ending 30 September 2019 suggest that c.28% of all Administrations moved to CVL in that year. So directors involved in connected pre-packs need to be aware of the phoenix provisions.

The problem is that there is no logic to the application of S216/17 to Para 83 CVLs.

It seems to me that directors of the healthier businesses are targeted. If the company has sufficient property for a non-prescribed part dividend, the Administration moves to CVL… and thus S216/17 are triggered. But if the company has no money for unsecured creditors (other than by way of a prescribed part), then it probably will move to dissolution… and S216/17 are not triggered. In other words, if the directors have pulled the plug when the company’s assets are still relatively meaty, then they risk falling foul of the phoenix provisions. But if they have bled the company dry and then bought the remaining business for a negligible sum, then they can avoid the phoenix issues!

Could ADM-to-dissolution be an abuse of the process?

Of course, a company should only go into Administration if it can achieve an objective. One of the big unanswered questions is: regardless of whether unsecured creditors receive a dividend from the Administration, does the survival of the business (involving TUPE-transferred employees, landlords with no gap in tenancy, customers with continuing services and products) achieve the second Administration objective of a better result for creditors as a whole than winding-up? I understand views are divided on this.

Setting this aside though, I think that it will be much easier to achieve the third Administration objective from April 2020. One of the problems with achieving the third objective in pre-pack scenarios is that there are usually no prefs, as all the employees are transferred to Newco. However, from April 2020, HMRC will become a (secondary) preferential creditor in the vast majority of insolvencies. Therefore, where a company has no employee prefs, the third Administration objective may be fairly easily achieved by paying a small distribution to HMRC… and then moving to dissolution. HMRC has handed would-be phoenix-avoiders a lifeline.

But if HMRC is a pref, won’t they control the process?

Some of you may be groaning: does this mean that we risk going back to the bad old days when HMRC used to modify Administrators’ Proposals so that most Administrations exited to liquidation? I don’t think so.

If the Administrator thinks that neither of the first two Administration objectives are achievable, then they make this statement – a Paragraph 52(1)(c) statement – in their Proposals. The consequence is that they don’t ask any creditors to decide whether to approve their Proposals, but these are deemed approved if no creditors requisition a decision. If HMRC (or any creditor, for that matter) wants to modify the Proposals to ensure that S216/17 are triggered by the Administration exiting to liquidation, they would need to put their hand in their pocket and pay Administrators to convene a decision process. I can’t see HMRC doing this, can you?

Of course, HMRC may still vote on Administrators’ fees – that’s a whole different concern.

What effect will all this have on pre-packs?

In summary, my thoughts on the future are:

- If the Pool is made compulsory for connected party pre-packs, undoubtedly this will reduce the number of pre-packs. Businesses will continue to be sold, but they will avoid falling into the statutory definition of “pre-pack”. Even now, we’re seeing more business sales that are considered to fall outside the SIP16 definition, with some IPs going to the length of getting legal advice for comfort.

- The new phoenix provisions, where HMRC will chase directors of serial insolvencies, will also reduce the number of pre-packs. Businesses will continue to be sold, but connections with former directors will be less likely (or simply less clear).

- Theoretically, the Insolvency Service’s focus on the technical intricacies of the current phoenix provisions should reduce the number of pre-packs or at least reduce the number of pre-pack Administrations exiting to liquidation… but it is not clear to me whether the Service is clobbering directors for technical breaches of compliance with Rs22.

- HMRC’s leg-up to preferential creditor could make pre-packs more attractive, as directors could more easily avoid the S216/17 provisions, but in reality I think this is too small a factor to influence directors’ decisions.

- It seems to me from my small sample that pre-pack practices have changed materially from early 2015. Therefore, what I would prefer to see from the Government’s review is empirical evidence on what has been achieved by all the 2015 reforms and what still remains to be remedied, before they take steps to legislate pre-packs.