I suspect that many of you (like me) have heard plenty of theory on the New Rules’ decision-making changes. Maybe reading it from the practical perspective of the work-winner will give it a freshness.

Some non London-centric IPs who missed out on my recent presentation for R3 expressed disappointment, so I thought a blog post was warranted. Here I have concentrated only on the S100 process.

S100 CVLs: Deemed Consent or Virtual Meeting?

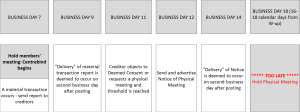

Before we start thinking about what we might discuss with directors, I think it’s worth weighing up the pros and cons of the two possible routes in to a CVL appointment… well, apart from a physical meeting, of course, but a physical meeting might be required whichever initial decision process we start with.

- Material Transactions

The rules don’t define a material transaction, but they do say that (R6.17):

“where the statement of affairs sent to creditors… does not, or will not, state the company’s affairs at the creditors’ decision date, the directors must cause a report… to be made to the creditors… on any material transactions relating to the company occurring between the date of the making of the statement and the decision date”.

That sounds to me like it’s any transaction that changes the SoA, but the InsS people I’ve spoken to don’t see this as wrapping in, say, changes in asset class where book debts are converted into cash at bank or where a forgotten van pops up. They say they intended the rule to ensure that creditors learn of events that might impact on the independence of the proposed liquidator, i.e. things that happened with his involvement or since his appointment in Centrebind cases.

Personally, I found this interpretation most surprising, as it’s really not what the rules say – and I’d love to get this down in writing from the InsS, as I think it’ll make a huge difference to the frequency of material transactions. (UPDATE 02/05/2017: Dear IP 76 simply states that a New Rules’ material transaction “is the same as 1986 rules 4.53B-CVL(1) and should be interpreted as such”… so we’re on our own on this one.)

So why should it matter?

Well, it won’t matter if you’re having a meeting, because you’d just report the material transaction to the meeting – it’s in our rules now, but it is never done (well I’ve never seen it done) because the SoA is usually signed off minutes before the meetings.

But it will matter if you’re working with the Deemed Consent process.

In this case, you must send out the report to creditors and if the report is delivered within 3 business days of the Decision Date, then the decision date moves to the end of 3 business days from delivery of the report.

This could leave you either in an unexpected Centrebind or needing to adjourn the members’ meeting.

- Fees Decisions – who knows?!

I have put question marks on the table above, as the rules are very unclear when it comes to proposing fees decisions around the S100 time. That’s so helpful, isn’t it? It’s not as if fees is something we need to get absolutely spot-on, is it..?!

The only thing we do know for certain is that Deemed Consent cannot be used for “a decision about the remuneration of any person” (S246ZF(2)). The rest is unclear.

Can you propose a fees decision via a correspondence vote to run concurrently with the S100 Deemed Consent process? I struggle with this, as I cannot see who has authority under the rules to “convene” such a Decision Procedure. The IP isn’t in office (and if he is the members’ liquidator, his limited powers do not extend to seeking fee approval) and the director only has the power to convene a decision by Deemed Consent or by virtual meeting.

Can fees decisions be considered at a virtual meeting? There is nothing in the rules that expressly addresses this, but at least the director does have the power to convene the virtual meeting. Is it not arguable that tagging on (pre and post) fees decisions corresponds to what we do with S98s now (especially as the New Rules expressly provide for the “proposed liquidator” to circulate fees information – R18.16(10))?

I have received conflicting opinions on the routes available from reliable sources. As the consequences of getting this wrong are so serious, I’m very reluctant to pass further comment and I do hope that the powers-that-be will put us all out of misery and tell us categorically – and before 6 April! – how/whether fees decisions can be made at the same time as the S100 decision, as R15.11(1) seems to suggest is possible… somehow.

- Timing

The deadline for the Deemed Consent process is 1 minute to midnight. The disadvantage here is that you won’t be certain on the decision until the next morning. I get the sense that most IPs are planning to hold their members’ meeting on the day of the Deemed Consent process, but this will still leave us with an inescapable Centrebind – it may be for only a few hours, but it’s worth thinking about it for insurance purposes at least.

On the other hand, virtual meetings can be held at anytime – the old between-10-and-4 rule has not been repeated in the New Rules. However, the convener still needs to “have regard to the convenience of those invited to participate when fixing the venue for a decision procedure” (R15.10), so the virtual meeting’s timing and “platform” (which has been added to the definition of “venue”) is still a factor to consider.

- Excluded Persons

The rules describe an excluded person as (R15.36):

“someone who has taken all steps necessary [to attend the meeting virtually or remotely, but the arrangements] do not enable that person to attend the whole or part of that meeting.”

In other words, the technology or signal for the virtual meeting has failed.

If the chair becomes aware of an excluded person, he can continue the meeting, suspend it for up to an hour, or adjourn it. If the chair decides to continue the meeting, resolutions can be taken and these will be valid but they’re subject to complaints from the excluded person or from any other attendee who claims they were prejudiced by the exclusion.

The timescale for complaints is short – before 4pm on the next business day from the meeting or from receipt of an “indication” of what occurred at the meeting – but the consequences can be far-reaching. The chair could review the voting and conclude that the excluded person’s vote overturns resolutions that had been thought passed.

Practically, where would this leave a liquidator who thought they were free to publicise their appointment and perhaps also to complete asset sales? I am not certain that these actions would be covered by the S232 defects-deemed-valid provision.

Clearly it is vital that office holders know where they stand immediately after a meeting, but how would they know whether there were any excluded persons? They may know if someone drops out of contact mid-stream, but what if someone could not get online in the first place? Obviously, this is a risk if the notice of the virtual meeting includes all the information necessary to attend… but is this what the Rules require?

R15.5 states that the notice to creditors must provide:

“any necessary information as to how to access the virtual meeting including any telephone number, access code or password required”

A couple of InsS people have told me that they believe that simply giving out a contact number so that creditors can ask for the login details before the meeting would satisfy this Rule – it is “necessary information”, after all. Clearly, this would be a great help in identifying excluded persons as well as going some way to “safeguard[ing] against participation by persons who are not properly entitled to participate” (SIP6) and helping to plan for sufficient access to a virtual meeting. Hopefully the InsS will confirm this in writing when they respond to a question about this on their blog. (UPDATE 02/05/2017: Dear IP 76 describes the Insolvency Service’s view as explained here.)

S100 CVLs: What Directors Need to Know

Please bear in mind that it has been a loooong time since I worked on the frontline. I do not feel worthy of explaining to IPs what they should discuss with directors pre-appointment. However, with the New Rules – and new SIP6 – in mind, here are my suggestions:

- S100/SoA fees

With the lack of clarity in the Rules, you’ll probably want to get your fees paid upfront. But what happens if you have to convene a physical meeting? Who is going to pay for that? It might be an idea to factor this in to your engagement letter: make sure that it’s clear what the fixed fee covers and what effect the cost of an additional physical meeting might make.

- Quick information

You’ll want to line the director up to providing information very quickly, given the short timeframes for compiling the SoA and the SIP6 report (see below).

- Post-SoA material transactions

It might be helpful to make the directors aware of the consequences of any material transactions occurring after the SoA is produced. The risk of a postponement in the Decision Date might help them to focus on giving you the whole story and avoid doing anything silly in the hiatus period.

- Postponed decisions

Material transactions or the need for a physical meeting will delay the S100 decision. If these events happen early enough, there might be a chance to adjourn the members’ meeting. But of course, if this happens, then the directors will be in control of the company for longer. What effect will this have on the CVL strategy?

You might also want to warn the director that they may need to attend a physical meeting. And will you be around for the physical meeting? Fortunately, the new rules have been relaxed a bit so that the members’ liquidator need not attend the physical meeting, he can appoint someone else in his stead (another IP or an experienced staff member), but if a physical meeting has been requested, then you might want to make sure you’re there.

- SIP6 additions to engagement letters

The new SIP6 states that the assisting IP should “take reasonable steps to ensure that the convener is made fully aware of their duties and responsibilities”, so you may need to beef up your engagement letter to set out the director’s duties to take appropriate action as regards objections, requests for a physical meeting, material transactions and excluded persons, all of which are the convener’s/chair’s responsibilities; and to provide the SoA/SIP6 required information swiftly.

SIP6 also requires “reasonable steps to ensure that… the instructions to the IP to assist are adequately recorded”. I’m not sure what the RPBs are getting at here, other than expecting a signed engagement letter. Do they want you to have set out whether your instructions are to proceed with the Deemed Consent or the virtual meeting route? And/or should you specify that you’ll be assisting with assessing objections and requests for physical meetings?

Connected with this is SIP6’s requirement to “take reasonable steps to ensure that the convener and/or chair is informed that it may be appropriate for them to obtain independent assistance in determining the authenticity of a prospective participant’s authority or entitlement to participate and the amount for which they are permitted to do so in the event these are called into question”. This isn’t surprising given that something similar is in SIP8 regarding the conflict risk when counting proxies, but it may be a good idea to put it in your engagement letter if it isn’t already.

- Excluded persons

Given the risk of excluded persons changing the outcome of meetings, you might want to be careful about what you indicate to directors that you plan to do on the day of, and the day after, the meeting.

S100 CVLs: The Unintended Centrebind

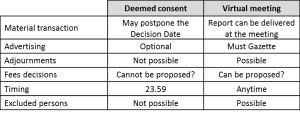

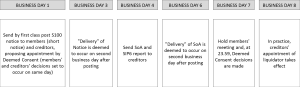

So what does the new S100 process look like? What needs to happen when?

Here is a timeline for a no-complication Deemed Consent, demonstrating the shortest notice possible (apologies if these timelines do not reproduce well on the website; if you click on them, you should be able to see them in full screen):

A virtual meeting timeline would work the same, but it would just mean that you’d be able to schedule the meeting on Business Day 7 for a sensible time instead of a minute to midnight.

In particular, note the time needed to send the SoA and SIP6 report in order to accommodate delivery in time. (UPDATE 23/03/17: it has been pointed out to me that SIP6 only requires the report to be “made available”, so some are interpreting this to mean that it does not have to be delivered to creditors (although the SoA still does need to be).)

But what if creditors object to the Deemed Consent at the last minute (i.e. after the members’ meeting had been held on business day 7)?

(UPDATE 23/03/17: it has been pointed out to me that requests for a physical meeting must be received “between the delivery of the notice and the decision date” (R6.14(6)) and thus it has been suggested that a physical meeting request received on the decision date will be too late (UPDATE2 02/05/2017: the Insolvency Service’s view, as set out in Dear IP 76, is explored further in my post, https://goo.gl/MCPh08). The deadline for deemed consent objections, however, is “not later than the decision date” (R15.7(2)), so I believe the timelines above and below are still relevant.)

You could fit the physical meeting within the statutory 14 calendar day timescale, provided that you can get the director to move quickly to convene it, but it would leave you managing an unintended Centrebind.

The picture looks grimmer if a material transaction occurs:

As you can see, there isn’t enough time to deal with a material transaction and a physical meeting. (UPDATE 02/05/2017: the Insolvency Service has expressed the view on its blog that “it is sufficient that the original decision date was within the required timescale”.)

Virtual meetings avoid this issue, as the report on the material transaction would occur at the virtual meeting. It’s not the whole answer to avoiding a Centrebind, as creditors could still request a physical meeting, but at least it could be held within the 14 days.

There’s More

As I mentioned at the start, I’ve limited this blog post to S100 decisions only – it’s long enough already.

If you want to listen to my whole presentation, you can purchase it via The Compliance Alliance (£250+VAT plus joining fee for firm-wide access to all our webinars for a year) – just drop a line to info@thecompliancealliance.co.uk.

Other topics covered include:

- The timeline of an intended Centrebind

- S100s for the IP acting for creditors

- VAs: correspondence vote or virtual meeting?

- Creditors’ powers and the process to seek an IP appointment in bankruptcies and compulsories

- Administrations: the pros and cons of seeking approval of Proposals by Deemed Consent or a decision procedure

- How creditors can stay in the loop on communications