I reckon that Administrations are the most complex insolvency procedures and the Oct 15 fees Rules made them a whole lot worse. However, Administrators’ Proposals provide valuable indications of how IPs – and creditors – have reacted to the new fees regime over insolvencies as a whole.

Only for Administrations are the fees proposals filed at Companies House, so they were ripe for review. I have gleaned many lessons on what not to do and I’ve also gathered a view of how IPs in general are structuring fees proposals in this brave new world.

I shared the fruits of my review at the R3 SPG Technical Reviews. If you missed my presentation, I set out here some of the highlights. The full presentation is also available as a webinar via us at The Compliance Alliance (see the end of this article for more details).

How many IP practices have I looked at?

Using the Gazette and Companies House, I have gathered 108 sets of Administrators’ Proposals on 2016 cases:

- Proposals from 69 different IP practices where unsecured creditors were asked to approve fees (i.e. a creditors’ meeting was convened or business was conducted by correspondence)

- Proposals from 39 different IP practices where fees-approval was limited to secured creditors (and in some cases preferential creditors)

- In total, 85 different IP practices are represented, from “SPG-sized” (i.e. using R3’s smaller practices criteria) to Big 4.

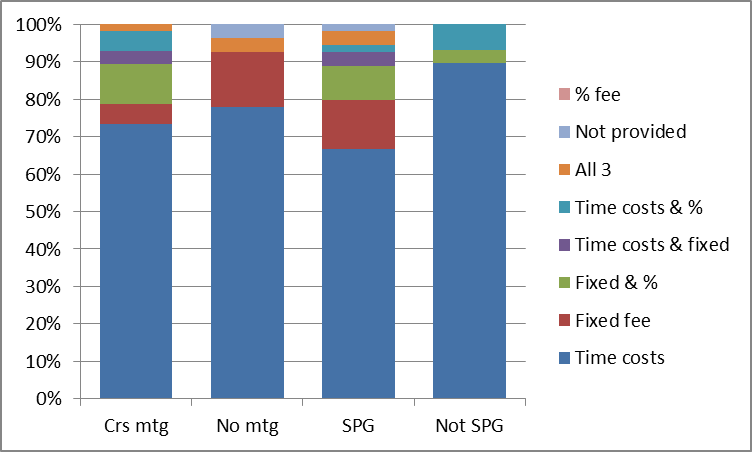

Time costs basis is still king

Ok, so that’s not a bombshell. I also accept that, if I were to look at CVL fees proposals, I might see a different picture.

However, this is the spread of fee bases for my Administration sample:

I’d be interested in running the exercise again, say in January 2017, to see if the picture has changed at all. I think that it depends, however, on whether creditors are looking any more kindly on non-time costs fees.

How are creditors voting?

Where unsecured creditors voted on fees proposals:

- 58 fees resolutions were passed by creditors with no modifications

- 6 fee proposals were modified

- Creditors’ committees were formed in two other cases

- One set of Proposals was rejected

The modified fees look like this:

- A fixed fee was reduced from £55K to £47.5K.

- A fixed fee of £10K plus 50% of realisations of uncharged assets was limited to the fixed £10K alone.

- A fixed fee of £33K plus all future time costs was restricted to a fixed sum of £40K.

- A time costs fee with an estimate of £30K was limited to £20K.

- A time costs fee with an estimate of £1.26m was subject to a complicated cap which effectively meant a reduction of c.6%.

- A time costs fee with no estimate was limited to the WIP at the date of the meeting of c.£20K.

I think it is interesting that proportionately more non-time costs fee cases were capped – 50% of all capped fees cases involved fixed/% fees, whereas fixed/% fees cases represent only 27% of the whole. It was a fixed/% case that suffered the greatest cut: a hefty 79%! The average reduction was 29% of the fees requested.

Four of the cases listed above also involved new IPs being appointed – in three cases as the subsequent liquidators and, in the other case, the administrator was replaced. In these cases, the original IPs were forced to vacate office early, so it is understandable that the proposed fees were clipped.

However, the IP who had been clobbered with a 79% reduction was not being fairly remunerated in my opinion. I found this case doubly depressing, as the Proposals were of good quality, lots of useful information was given and it was clear that the IP had worked hard. On the other hand, I saw lots of Proposals that at best were clumsy and vague and at worst contained fundamental breaches of statutory requirements.

Statutory and SIP slip-ups

My presentation included some examples of seriously scary statutory breaches that really should never have happened, but I will spare the authors’ blushes by covering them here. However, we’re all trying hard to comply with Rules and SIPs that often make you go “hmm…”, so I can understand why slip-ups happen.

Sharing only some information with unsecured creditors, because fees are being approved by the secured creditors alone

Do you need to provide full details of the fees that you are seeking in your Administrator’s Proposals, if the Act/Rules only require you to seek secured creditors’ approval? My sample indicates that a couple of IPs at least believe not.

Personally, I think that the Oct 15 Rules are clear: the office holder must, “prior to the determination of which of the [fees] bases… are to be fixed, give to each creditor of the company of whose claim and address the administrator is aware” either the fees estimate (if time costs are being sought) or details of the work the office holder proposes to undertake (if another base is being sought) and in all cases details of current/future expenses.

I do not think it complies with statute to state that this information is only going to be given to the secured creditors (or indeed to a committee, which is a similar scenario). Of course, this does not mean that you must provide all this information in the Administrators’ Proposals – although remember that R2.33 requires Proposals to include the “basis on which it is proposed that the Administrator’s remuneration should be fixed”. The fees-related information (to support a request for approval of the basis) could be provided under separate cover, but it does need to be sent to all creditors.

Failing to justify fixed/% fees

I think that some IPs have been caught out by the SIP9 requirement that we need to “explain why the basis requested is expected to produce a fair and reasonable reflection of the work that the office holder anticipates will be undertaken”.

Some Proposals seemed to lack any attempt to provide this explanation. This included one set of Proposals on which the fees were proposed on a time cost basis plus a “success fee” of 7.5% of asset realisations on top, which clearly needed substantial justification.

Other Proposals simply included a statement such as “I consider the proposed basis is a fair and reasonable reflection of the work that I propose to undertake” – not good enough, in my opinion.

The R3 SIP9 Guidance Note suggests referring to “prevailing market rates”. Before the new OR fees had been announced, I wondered how this might work in practice, but now I think that many fixed/% fees can be more than justified by comparing them to the OR’s starting point of £6,000 + £2,000 to £5,000 + 15% of all realisations (what, even cash at bank?).

Personally, though, I do think that time costs is generally a fair and reasonable reflection of work undertaken, so I think that comparison of a fixed/% fee to what the time costs might be is justification, isn’t it? I don’t mean that you need to include time costs information, but simply a statement that you would not expect a time costs basis to be any cheaper… although make sure that you can back this up internally, as I understand that some monitors are querying the quantum of some fixed/% fees.

Presentation problems

There is no doubt that over the years many layers have been added to statutory reports such that Administrators’ Proposals and progress reports for all case types have become ridiculously unwieldy – and of course very expensive to create and check. Then, we have the SIPs that layer on yet more requirements to reports. And don’t get me started on the R3 SIP9 Guidance Note!

With this backdrop, I have to bite my lip whenever I hear/read a regulator or similar express the opinion that items such as fees proposals can be dealt with in short order. I’ve even read that, for simple cases, a fees estimate could be “little more than a few lines of text”! I am ever conscious, however, that it is a temptation of compliance specialists to throw kitchen sinks at statutory and SIP requirements.

Although I accept that Administrators’ Proposals involve often lengthy schedules such as creditors’ lists, my sample had an average length of 41 pages and the longest was 97 pages! It has become silly, hasn’t it?

The mass of information provided in Proposals leads to presentation problems over and above simply helping creditors to trawl through it all.

Documents that just don’t match up

Administrators’ Proposals involving fees proposed on a time costs basis should contain the following numerical items:

- A receipts and payments account

- A statement of affairs (“SoA”) or estimated financial position

- An estimated outcome statement (“EOS”) (optional)

- A fees estimate

- A schedule of anticipated expenses (“expenses estimate”)

- A time costs breakdown (proportionate to the costs incurred)

- A statement of pre-administration costs

A common problem in my sample was that all these documents did not cross-check against each other. Most frequently, the expenses on the EOS did not match the expenses estimate. The picture was generally worse in non-time cost cases where sometimes an expenses estimate (or at least “details” of expenses anticipated to be incurred) was missing altogether. Another issue in non-time cost or mixed bases cases was that my calculation of the expected fee did not match that listed in the EOS.

It is not surprising that mistakes happen with so many schedules to produce and I do realise that we need to manage costs and get these documents out reasonably swiftly, but I do think that a failure to get all these items cross-referring correctly is an easy way to get on the wrong side of a voting creditor (and RPB monitor).

Estimating dividends

I don’t wish to discourage you from providing anticipated dividend figures – especially as we now have the SIP9 requirement that “where it is practical, you should provide an indication of the likely return to creditors” – but it was noticeable that some Proposals that included estimated dividend figures were fraught with difficulties.

How can you estimate the dividend from an Administration if:

- you only disclose fees on a milestone basis, e.g. for the first six months; or

- where a non-prescribed part dividend is anticipated, you only estimate the Administrator’s fees, not the fees and expenses of the subsequent CVL?

In these cases, I think you need to make it clear that the bottom line of any EOS does not equate to a dividend, not even to a “surplus available for creditors”, but perhaps the balance after six months (or whatever the milestone happens to be) or the estimated funds to be transferred to the liquidator.

The worst case I saw was an EOS that suggested a 14p in the £ dividend, but when the rest of the Proposals were factored in (especially some expenses that hadn’t made their way to the EOS), it was evident that there would be no dividend and the IP would not recover his time costs in full.

I think it is important to manage creditors’ expectations; do not set yourself up for a fall.

Liquidation estimates

Few Proposals included clear information on the subsequent Liquidators’ fees and expenses: this was present in 10 Proposals out of 63 that indicated a likely non-prescribed part dividend. That is fine, this information is optional under the Rules.

What concerned me, however, was how muddy the water looked in some of the other 53 cases. For example, one Proposal listed adjudicating on claims and paying a (non-prescribed part) dividend in the work to be undertaken, but the surrounding text suggested that the estimate was for the Administration only.

I think it is important to be clear on what the fee estimate covers and also what it does not cover, especially if non-routine investigation work is to be dealt with separately or later.

Although the Rules provide that the basis of the Administrators’ fees carries over automatically to the Liquidation (provided that the IP is the same and that both the Administration and the Liquidation commenced after 1 Oct 15), it seems to me that the quantum of fees that have been approved could be a little trickier to determine. This does not just concern time costs: when you start working through an actual case, you realise that the Rules are very woolly (and I believe even conflict in some respects) as regards Liquidators’ fees approved on a fixed/% basis in the prior Administration.

The narrative

I am the first to confess that I struggle to get the balance right as regards the Rules and SIP9 requirements for narrative. As my blogs demonstrate, I’m not known for being concise!

My review of over 100 Proposals, however, has led me to the following personal conclusions:

- A good EOS can tell the story far better than pages of text. I hated seeing an EOS or an SoA with strings of “uncertain” assets.

- I guess we need to include some narrative to explain the statutory and general administration tasks, but, really, once you’ve read one, you’ve read them all. Yawn!

- The R3 SIP9 Guidance Note suggests adding the number of creditors, number of statutory reports, returns etc. to your narrative. In view of the costs incurred in tailoring this information to each individual case, I really don’t see that it is effort well spent. Will creditors really thank us?

- Ok, yes, explaining prospective/past asset realisations is the meat of our reports. Especially if you do not have an EOS or if realisation values truly are uncertain, fleshing out what you have to realise and how you are going to go about unusual realisations would be valuable.

- What to do about Investigations? I wriggled a bit when I was asked this question at the R3 event. Many IPs are being sensibly cagey when it comes to proposing what Investigations will involve. This is an area where proportionality really is key: if you are expecting to charge a lot, then I think you do need to give creditors some of the story, although you will want to be careful of your timing and the risk of potentially giving the game away.

Other Insights

In my presentation, I also shared other insights from my Proposals dataset, such as whether the amounts of proposed fees tallied with the expected realisations and what was the average and range of charge-out rates, but I think it would be insensitive to share the detail so publicly here.

Nevertheless, here are some general observations from my review:

- I saw no real difference in the ratio of fees proposed to asset realisations where unsecured creditors controlled approval as compared to that where secured creditors were in control. Although I am no statistician, I think this is interesting in view of the OFT’s conclusion in 2010 that fees were higher when unsecured creditors were in control.

- Although time costs are still overwhelmingly preferred, other and mixed bases are being proposed in a variety of cases, including some with substantial assets.

- Only 26% of time cost fee estimates broke down anticipated time into staff member/grade, i.e. to the level of detail suggested in the R3 SIP9 Guidance Note. I am yet to be persuaded that it is in creditors’ interests to go to the expense of providing this level of detail, which I do not believe is required by the Rules or SIP9.

Personally, I’ve learnt a lot from the review – what can go wrong, where some seem to be getting into a muddle, how IPs and creditors have reacted to the new fees regime. Although I spent many (sad) evenings trawling through Proposals, I shall be doing this again sometime to see whether things have changed.

If you would like to listen to the full webinar (£250+VAT plus joining fee for firm-wide access to all our webinars for a year), please drop a line to info@thecompliancealliance.co.uk.